Taken from this LinkedIn post by Dean Casey

AI can revolutionize your wealth management business, but only if implemented correctly.

Here are 3 key steps to get started:

Understand the basic terms. This knowledge is crucial for making informed decisions. Let’s look at some of the key terms at the moment:

ChatGPT is a type of large language model (LLM) AI. This is a concept important to technical people but not really relevant to business decision makers. Sadly it often gets thrown into sales conversations to make it sound important.

You could use RAG system to review long and tedious documents, summarise and extract quick insights from them. This could dramatically simplify market research.

Or, automatically generate personalized, context sensitive messages to clients based on their risk profile, personal details and market events.

2️⃣ Create a clear strategy

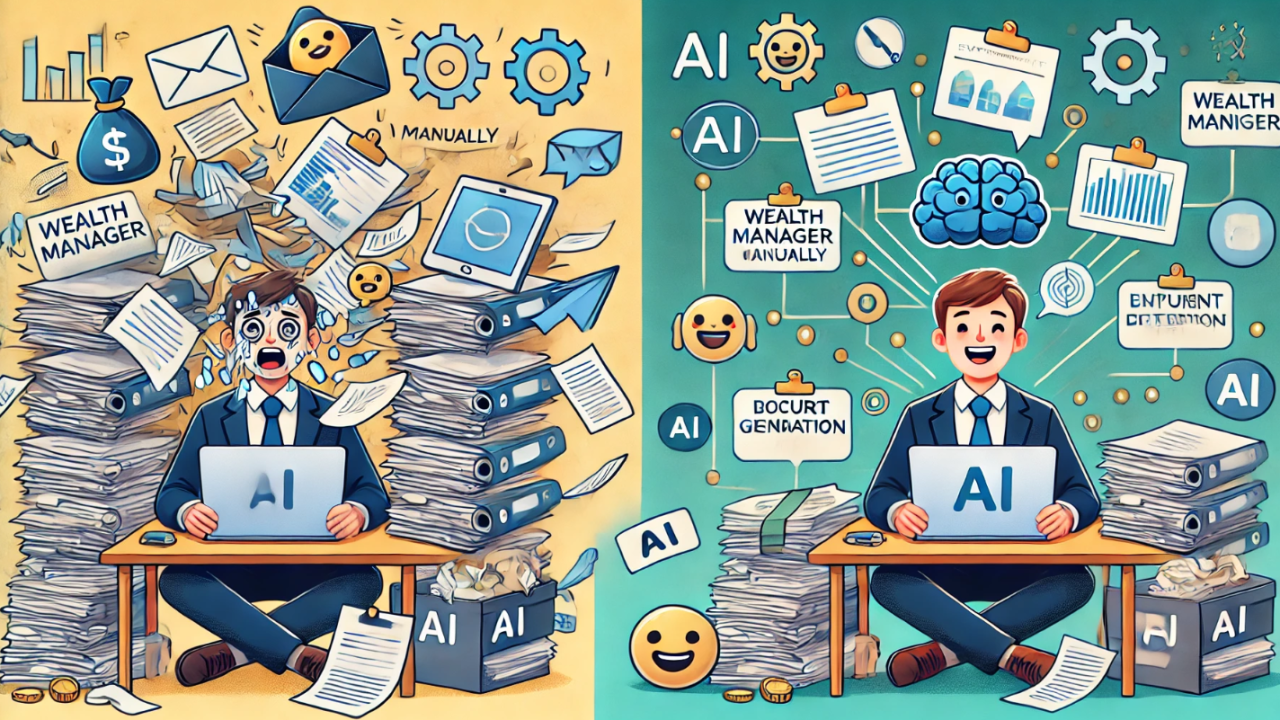

Most wealth managers are overloaded and short of time, reviewing research reports, summarising meetings, sending personalised emails to clients. Growing their business without sacrificing the high quality personal service they offer is always a challenge.

Sound familiar?

Then an AI solution can help but it is not about just selecting an AI vendor from a directory or Google search. You need a plan:

Here’s a simple framework to get started:

👉Identify process pain points: What tasks are time-consuming or prone to errors that would benefit from automation? Good examples: Manual data entry for client onboarding, personalised client messaging and client reviews

👉 Set specific measurable goals: Select only one pain point at a time. Make sure that it has a measurable before and after metric. For example: document and research report summaries, personalised client reporting

👉 Choose metrics: How will you measure success? Example: Time to complete onboarding, error rates, client satisfaction scores

👉 Plan your approach: Will you build in-house, use off-the-shelf solutions, or partner with a vendor?

❌Don’t jump in without a vision, strategy and plan – that’s a recipe for disappointment.

3️⃣ Start small (Remember there is no rush)

The success of the project will help get buy-in from your team and be a learning experience for the impact on your business. It will make selecting the next project or expanding the initial project much easier.

There are many beginner-friendly AI projects for wealth managers. Here is a quick example to help with understanding:

👉 Automated Meeting Transcription and Client Messaging:

Before AI – Manual labour

You meet a new client for the first time. You have a great conversation with them. They agree to proceed. You now need to:

😩 Summarise the meeting with them

😩 Send them a personalised thank you for the meeting email

😩 Ask them onboarding questions and do risk profiling

😩 Then create a personalised wealth plan

How long does that all take? Hours?

After AI – Automated & easy

😀You meet with the client and fire up your meeting recorder AI app on your phone.

😀When you get back to your desk

The meeting summary has been done,

The thank you email is drafted and ready for you to click send.

The appointment for onboarding & KYC has been automatically sent.

😀All you need to do now is use your expert knowledge to create an investment plan for the client or use one of your models.

😀You do this and send it to your AI assisstant.

It drafts a wealth plan document with a personalised coversheet

Sends it to you for approval

Sends it to the client for their signature,

This is done electronically using your custom white labelled mobile app. The client is impressed with the speed and simplicity of the process.

😀All done!

How much of your time did that take? Less than 5 min!

There are many easy to get started projects you can do with AI.

✅ Begin with simple projects which will offer quick wins and valuable learning experiences.

But beware of these common pitfalls

❌ Rushing in without a plan

❌ Feeling pressured to transform overnight

❌ Compromising client privacy with public AI tools

Let’s dive deeper into that last point:

Client Privacy and AI: A Critical Concern

Many popular AI tools like ChatGPT use public databases. This means any data you input could potentially become part of their training set.

⚠️ For wealth managers, this is a huge risk. ⚠️

💥Imagine if confidential client financial information ended up in a public AI model!💥

Instead, consider:

✅ Working with AI vendors who specialize in financial services and understand regulatory requirements

✅ Implementing on-premises AI solutions that keep your data within your control

✅ Using RAG systems that can leverage your internal data without exposing it to external sources

Remember: Your business is successful right now. Clients value their relationship with you. There’s no need to rush!

Embrace AI thoughtfully. It can power growth and enhance customer service, but needs careful implementation.

Would you like to see a Demo?

If you would like to see a practical demo, then please write “AI Demo“ in the comments below and I will send you a link to the video I have recently made.

Stay tuned and have a great weekend!

PS Want to fast track this knowledge? Contact me and lets have a chat.