Taken from this LinkedIn post by Dean Casey:

The solution? Automation

But “automation” is a vague concept, always thrown around, but difficult to understand in practise?

Here’s a real case study from our 25+ years of helping wealth managers grow:

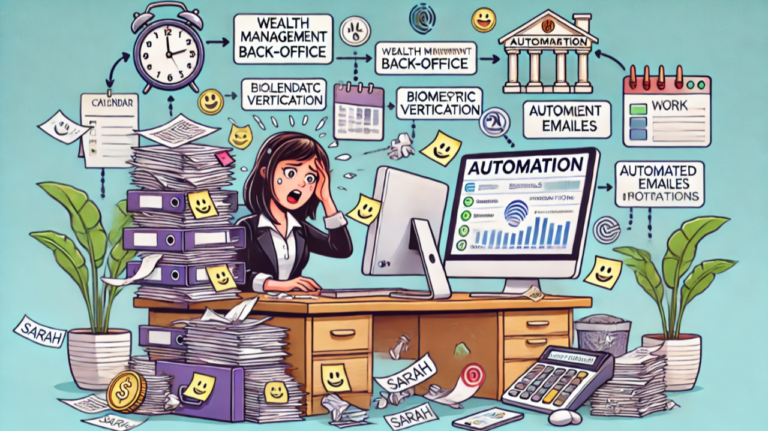

Meet Sarah (not her real name), head of back-office admin, drowning in payment processing nightmares:

She was spending more than half the month on this tedious task, every month!

Let’s dive deeper into Sarah’s situation:

Sarah’s typical day was chaotic. She had to manually verify and capture every single request. It required her to:

The process was not only time-consuming but also incredibly stressful. One small mistake could lead to:

As head of back-office admin, the buck stopped with her. And, she still had to manage her team and ensure all the other back-office admin tasks for the wealth management firm were done properly and on time.

Sarah was at her wit’s end, even considering quitting her job.

We developed a system that automated the entire process. Some of the key features:

Let’s explore this in more detail:

By adding a payment capture screen into the web portal and/or mobile app, clients could now request ad-hoc payments or schedule regular payments themselves.

The benefits of using a digital channel is as follows:

- Clients are already authenticated (and this is audit tracked)

- The payment request form requires entry of ALL the relevant details such the investment account, the time, the amount before submission. No gaps

- A monitoring screen where the client can view all their requests, their latest status and view the full audit trail of their request.

An internal admin view of all current and pending requests was provided to Sarah. She could drill down into the details of any request and see the entire audit trail of any individual request.

The requests were color coded for easy viewing. Red for cash “not available”, yellow for “in-work” by the portfolio manager and green for “cash available”.

At a glance she could see the status of all requests in the system.

On a daily basis, the system would automatically check that cash was available, in the requisite account, for all the pending requests.

The system included pro-active checking for cash availability that required an investment sale with a time-consuming settlement period.

If the required cash was not going to be available, an information warning was sent automatically and electronically to the client, asking for their confirmation. Once received, again electronically, the request was re-routed to the portfolio manager to instruct them to sell investments.

The portfolio manager would update the system confirming the request was received and again for each step in their process.

Each step was fully audit tracked and visible to all stakeholders, including the client.

When ready, Sarah would click a “Request for approval” button on her screen. All validated payments were displayed on her manager’s approval screen with an approve/reject option for each request.

The manager could also see the individual audit trails and the steps the request took from initial capture to “ready for approval”.

Apart from the client’s initial request, there was no manual data capture or data entry at any stage during the request workflow!

Once approved, Sarah sent all payments requests to the banking system with the click of a button.

Behind the scenes the system exported the all the approved requests to a text file using the requisite format for their banking system. The file was uploaded and acknowledged by the banking system with a response code. This was added to each payment requests audit trail.

The payment request was marked as complete!

Dashboards and drill down reports of pending request, completed requests were added to the system. Sarah could retrieve reports on any or all current or historical payment requests with their audit trails

Compliance and audits became a simple process

The results?

Think of all the other scenarios in your business that this could apply to.

For example

Remember

Automation isn’t just about efficiency. It’s about empowering your team and delighting clients.

Stay tuned and have a great weekend!

PS Want to see how automation can transform your wealth management firm? Contact me to chat about your specific needs.

#WealthManagement #WealthTech #FinTech #Technology #DigitalOffering #Automation #CustomerExperience #DigitalOffering #HyperPersonlisation